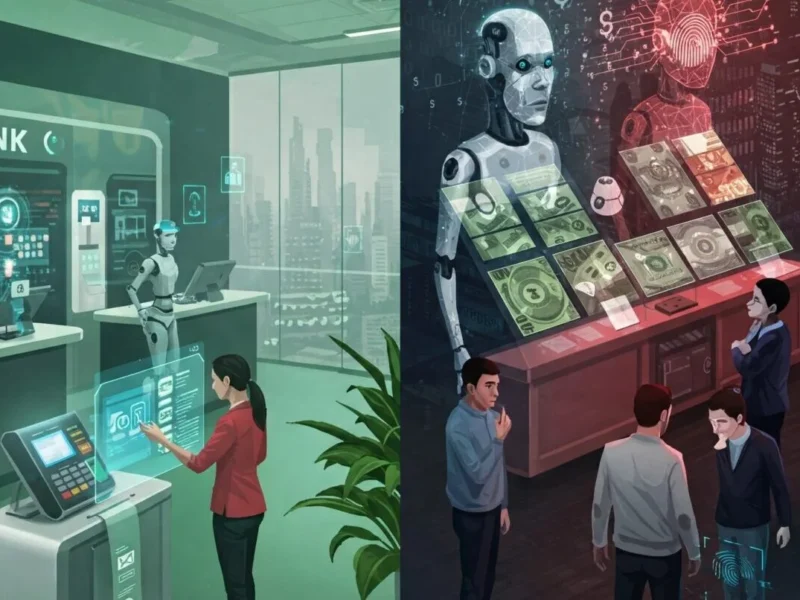

The silent revolution behind the cash machine: how artificial intelligence is transforming the face of the banks, between the promises of efficiency and risks of discrimination

Imagine that you enter the bank, and to be welcomed by a consultant who knows you better than your family: know exactly when you receive your salary, expect your future expenses and suggest investment custom even before you ask. This consultant is never tired, does not go in the lunch break and never has a bad day. It is called artificial intelligence, and is already changing the way in which the banks operate.

The AI in banking is not science fiction: banks like JPMorgan Chase and Bank of America have developed virtual assistants, advanced, Erica, a chatbot that provides suggestions customized financial. But behind these innovations are hiding deep questions: what happens when algorithms decide who deserves a loan? And if the artificial intelligence ereditasse our prejudices deeper?

What is the AI in banking and why it is changing everything

The artificial intelligence in the banking sector is a set of technologies that enable computers to perform a variety of advanced features, including the ability to analyse data, make recommendations and take decisions that directly affect the financial lives of millions of people.

According to a survey of the ABI Lab, the 51% of the Italian banks are using Artificial Intelligence, with applications ranging from security management (48%) to customer support via chatbot (43%), up to the optimization of internal operations (29%). It is no longer an experiment, but an established reality that is redefining the industry as a whole.

The AI in banking is manifested in three main areas:

Intelligent automation: Technologies, RPA (Robotic Process Automation) allows automating administrative tasks such as document processing and management of requests of our customers, reducing waiting times and improving productivity.

Predictive analytics: The algorithms can predict behaviors and future by analyzing huge amounts of historical data, from spending habits to the risk of insolvency.

Intelligent interface: Chatbot and virtual assistants that offer 24/7 support, Erica, Bank of America, a virtual assistant in addition to responding to customers ' questions, it is also able to learn from the interactions obtained thanks to deep learning, and send notifications to customers, suggesting which are the areas where they can save money.

The advantages that are revolutionizing the banking

Enhanced security against fraud

Using machine learning algorithms, the banks are able to analyze in real-time processing millions of transactions and identify suspicious activity. A concrete example? The artificial intelligence system that is “Black Forest” of Deutsche Bank analyzes transactions and records of suspected cases. For each movement of capital are taken into consideration several criteria: amount, currency, country towards which it is directed, and the type of transaction.

The results are tangible: thanks to this application, have already uncovered several cases of fraud and tax evasion, including one relating to organized crime and money laundering.

Credit scoring is more accurate and inclusive

The AI is revolutionizing the assessment of the credit. The banks are using AI to evaluate credit risk more accurately and faster than with traditional scoring models. Through the analysis of historical data and behavioral patterns of the customers, the models of machine learning can predict the probability that a customer fails to repay its debt.

The use of artificial intelligence on the part of banks allows you to develop more effectively the information is quantitative, and can reduce the information asymmetry between intermediaries and their customers, according to a recent study of the Bank of Italy.

Customization services

The AI allows banks to offer a personalized experience to the customers, analysis of the data of their transactions, preferences, and behaviors. A bank may suggest a specific financial product to a client according to his spending habits or offer an investment plan focused.

Banks use Artificial Intelligence systems to analyze the spending habits of the customers and offer personalized advice on investments, savings and lines of credit.

Operational efficiency without previous

The automation of routine tasks and time-consuming, as document processing, data entry and compliance controls reduces the manual workload, minimize errors, and lowers operating costs.

A practical example: some banks have implemented systems based on AI to automatically analyze financial documents, accelerating lending practices and increasing the ability to respond to new requests.

The hidden risks: when the algorithm discriminates

The problem of bias algorithmic

The bias algorithmic occurs when a model produces systematically results in distorted to the detriment of certain groups. In the field of credit, this can mean the unjustified refusal of requests from persons belonging to minorities, or the attribution of the conditions worse.

An emblematic case is that of the Amazon, which has had to scrap its system of recruitment based on the IA because discriminated again systematically the women candidates. The algorithm had learned from historical data that the men were more often employed in technical roles.

In the banking sector, this translates into discrimination invisible but real. All the large financial institutions have huge datasets on the financial profiles of the customers, which, when integrated with the operation of the machine learning, can produce bias.

Privacy and control of data

The IA is based on the collection of massive and personal information banks must ensure the protection of data of our customers, complying with regulations such as the GDPR and preventing possible violations and misuse.

An algorithm developed or a virtual assistant AI would be able to decide whether a customer is eligible to obtain a loan or to receive a particular offer. However, this type of automation comes into conflict with art. 22 of the GDPR, which explicitly prohibits companies to make automated decisions which produce legal effects as significant.

Transparency and “black boxes”

One of the most pressing problems is the lack of transparency. Transparency is particularly important in the areas where the AI takes decisions that have a significant impact on people's lives, such as finance. If an AI system rejects a bank loan, it is essential that the affected people have the right to understand the decision-making process.

The need of the XAI (Explainable Artificial Intelligence) is shown by the fact that many of the advanced models of THE are often considered as “black boxes”. This means that, although they are able to produce results highly accurate, the process by which they arrive at these conclusions remains opaque.

The regulatory framework of the Act for europe

To address these risks, the European Union has approved TO Act, the first comprehensive legal framework in the absolute on the IA at the global level. From February 2, 2025 will be in force the provisions of the european Regulation on artificial intelligence-related systems that would pose an unacceptable risk.

The increasing popularity of AI is both an opportunity and a challenge. On the one hand, THE Act introduces a clear regulatory framework, which aims to balance technological innovation with consumer protection.

For banks, this means:

- High-risk systemsSystems TO high-risk should have a risk management system that iteratively identify, evaluate, and manage the possible risks

- Transparency mandatoryCompanies must be able to explain how and why they are taken certain decisions

- Continuous monitoring: It is necessary to ensure that the systems of IA are transparent, with the ability to track the decisions algorithmic

The impact on the banking work

According to a report that examined the banking giants such as Citigroup, JPMorgan Chase and Goldman Sachs Group, Chief Information and Technology Officer interviewed said that on average, expected a net cut of 3% of their work force.

However, the reality is more complex. Teresa Heitsenrether, who oversees the efforts of JPMorgan in the field of AI, said that the adoption of THE generative part of the bank has so far increased the jobs.

The transformation seems to be directed towards a hybrid mode of analysts, human, and rather than a simple replacement.

Examples: banks, intelligent action

JPMorgan Chase and machine learning

COIN, the chatbot launched in 2016 by JPMorgan Chase, is the demonstration that the operations of the back office may be a revolution. The system analyzes legal contracts in a few seconds, a job that would require of 360,000 hours of human labor.

DBS Singapore and the total assistance

The DBS Singapore has created a chatbot that is considered to be a assistant bank virtual at the complete disposal of the customer. The interactions occur via voice or text, and the server can anticipate and respond to more than 10,000 common questions.

Santander and the voice recognition

Santander UK has launched a technology based on the speech recognition within their app SmartBank in a way that will allow its customers to use only your voice to manage their savings.

Towards a balanced future: banks in human and intelligent

The challenge is not to decide whether to embrace or reject the AI, but how to implement it responsibly. Most of the models that use artificial intelligence to react in a manner similar to the incentives provided by the users is more likely to behave incorrectly when they are told that unethical actions lead to substantial monetary gains, according to a study by the Bank of Italy on the ethics of AI in the financial sector.

Best practices for AI in banking manager

- Diversity in the development team: It is more than ever essential to involve and collaborate with the various stakeholders and engage them in the design, development, implementation and evaluation of the system TO the

- Audit continuous: It is necessary to identify and understand the sources of bias that may influence the project, and evaluate the impact and risk of bias

- Transparency algorithmic: The principle of transparency, the cornerstone of the GDPR and the new IA Act, guarantees IA, reliable and ethical. Essential to the financial sector, allows you to process data with accuracy, while improving services and safety

- Supervision human: Human intervention is crucial to verify that the systems of the IA act in respect of the principles of equity, transparency and accountability

New opportunities: the robo-advisor and the democratization of the investment

Robo-advisors offer personalized financial consultancy at a reduced cost. These tools of financial advice based on IA analyse the risk profile and financial goals of the user in order to suggest investment strategies tailored. According to a study by Business Insider Intelligence, by 2025, the robo-advisor will manage more than 4,600 billion dollars in assets globally.

Conclusion: A new contract of trust

The artificial intelligence has the potential to make the banking system more efficient, inclusive and safe. With the adoption of ethical practices, transparent and secure the IA can become a powerful ally in the digital transformation, improving the services offered and strengthening the trust of our customers.

But this transformation requires vigilance. If properly governed, the digital lending is a great opportunity for the sustainability of the financial system. But, most importantly, can help to bridge the credit gap that still afflicts millions of people excluded from the circuit to the formal banking.

The future of banks, smart will not be determined by the technology itself, but from our ability to build a new contract of trust between man and machine. A contract where the efficiency of the algorithm is combined with the human empathy, where innovation serves the inclusion and where transparency becomes the foundation for every decision automated.

The revolution in banking is started. It depends on us to make sure that it is a revolution for all.

Insights related:

- What is Artificial Intelligence (and what isn't, really)

- Bias Algorithmic: IA and Discrimination Invisible

- AI and Human Rights: The Balance between Technology and Personal Freedom

- Ethics of Artificial Intelligence: Why it concerns us all